how to declare mileage on taxes

Ad Edit Fill eSign PDF Documents Online. How To Declare Taxes As An Independent Consultant Sapling Business Mileage Lularoe Business Business Tax.

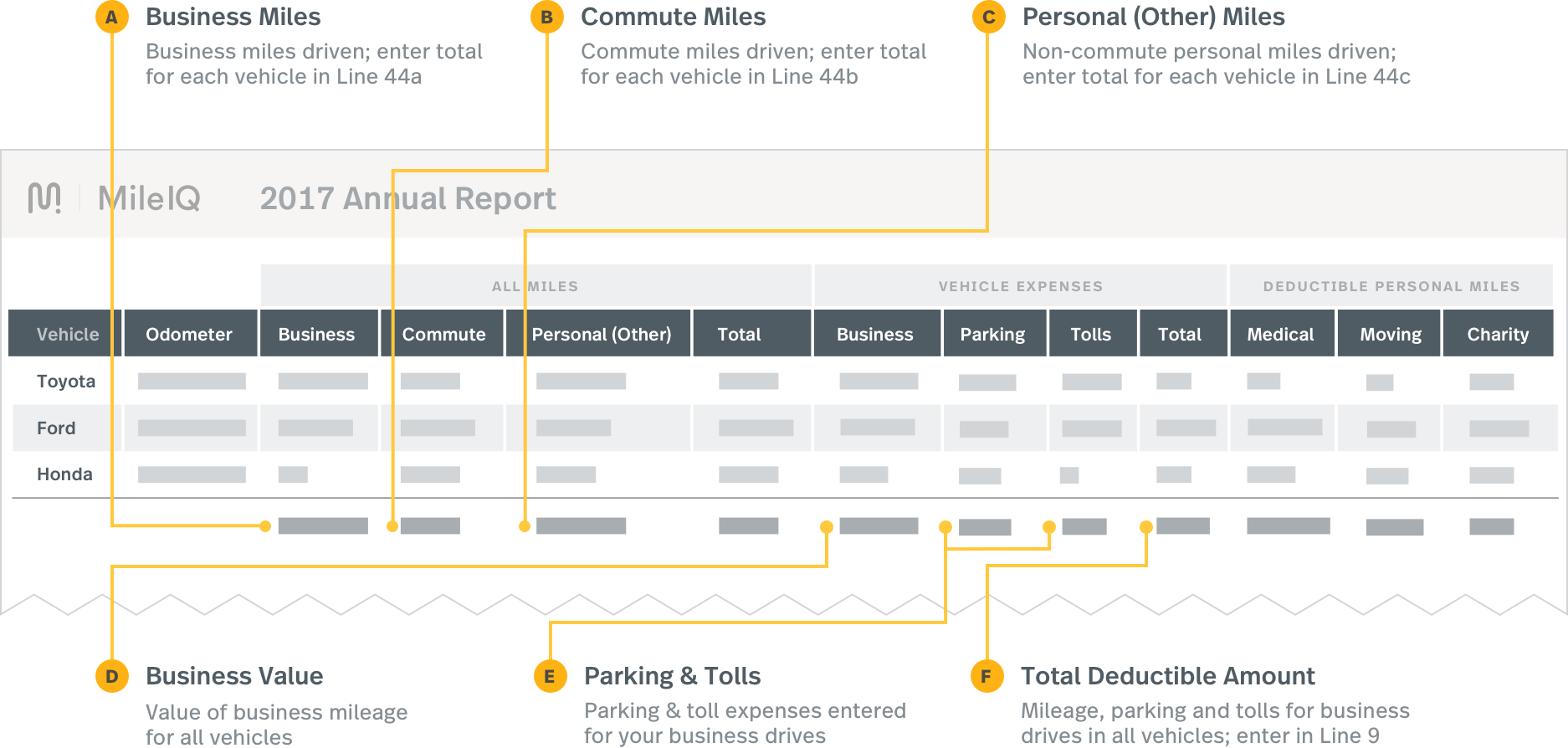

Reporting Mileiq Mileage With Tax Software Mileiq

The dollar deductible amount is determined by.

/Calculating_Mileage_for_Taxes_GettyImages-88327427-f6e3ca37a370470f9c3958ab60cf19dd.jpg)

. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. Connect With A Live Tax Expert And Be Confident You Get Every Dollar You Deserve. Mileage tax is a type of tax that is paid by the driver based on miles driven.

If you use your vehicle for business 80 of the time that means you will be able. You need to keep track of your total number of miles that you drove during the year and the total number. 18 cents per mile.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Gas repairs oil insurance registration and of course. It includes factors like gasoline prices wear-and-tear and more.

The standard mileage rate is easy to calculate. Reduce The Stress And Minimize Your Tax Obligations With Tax Services From A Paro Expert. The employer reimburses at 15p per mile for a total of 1725 11500 at 15p.

Ad Get Unlimited Tax Advice With TurboTax Live As You Do Your Taxes From Start To Finish. 14 cents per mile. For 2017 you can claim.

How To Declare Taxes As An Independent Consultant Sapling Business Mileage Lularoe Business Business Tax. The maximum claim is 10000 miles at 45p and 1500 at 25p for a total of 4875. Miles driven for business.

Connect With A Live Tax Expert And Be Confident You Get Every Dollar You Deserve. You must pay tax on. If you used your.

545 cents per mile. Theres no limit to the amount of mileage. Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle.

Standard Mileage Rate. Select Popular Legal Forms Packages of Any Category. When filing your taxes youll enter the total number of miles driven on Form 2106 Line 12 Total miles the vehicle was driven during 2020.

Professional Document Creator and Editor. Every feature included for everyone. Ad Get Unlimited Tax Advice With TurboTax Live As You Do Your Taxes From Start To Finish.

If you are an employee you cannot deduct gas mileage as an unreimbursed expense. The IRS sets a standard mileage reimbursement rate. All Major Categories Covered.

You can think of it as a pay-per-mile tax that subsidizes government programs and can be thought of as. You must file a tax return if you have net earnings from self-employment of 400 or more from gig work even if its a side job part-time or temporary. Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p plus 2000 x 25p.

Miles driven for charitable purposes. Of course the IRS isnt going to take your word for it. We make filing taxes delightfully simple with our flatrate price.

Miles driven for medical or work-related moving. Rates per business mile. Deduct your mileage expense to lower your taxable income.

That means the mileage deduction in 2022 2021 rate is different from previous years.

.png)

Mileage Vs Actual Expenses Which Method Is Best For Me

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Self Employed Mileage Deduction Rules Your Guide To Deducting Mileage

How To Claim Mileage And Business Car Expenses On Taxes

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Mileage Log Template Free Excel Pdf Versions Irs Compliant

What Business Mileage Is Tax Deductible

How Do Food Delivery Couriers Pay Taxes Get It Back

/Calculating_Mileage_for_Taxes_GettyImages-88327427-f6e3ca37a370470f9c3958ab60cf19dd.jpg)

Irs Announces Standard Mileage Rates For 2022

Mileage Vs Actual Expenses Which Method Is Best For Me

What Are The 2021 2022 Irs Mileage Rates Bench Accounting

Mileage Tax Deduction Claim Or Take The Standard Deduction

What Are The Mileage Deduction Rules H R Block

Federal Tax Laws On Mileage Reimbursement Turbotax Tax Tips Videos

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos